🗻Fuji DAO

A partner-project of the Hundred Finance platform

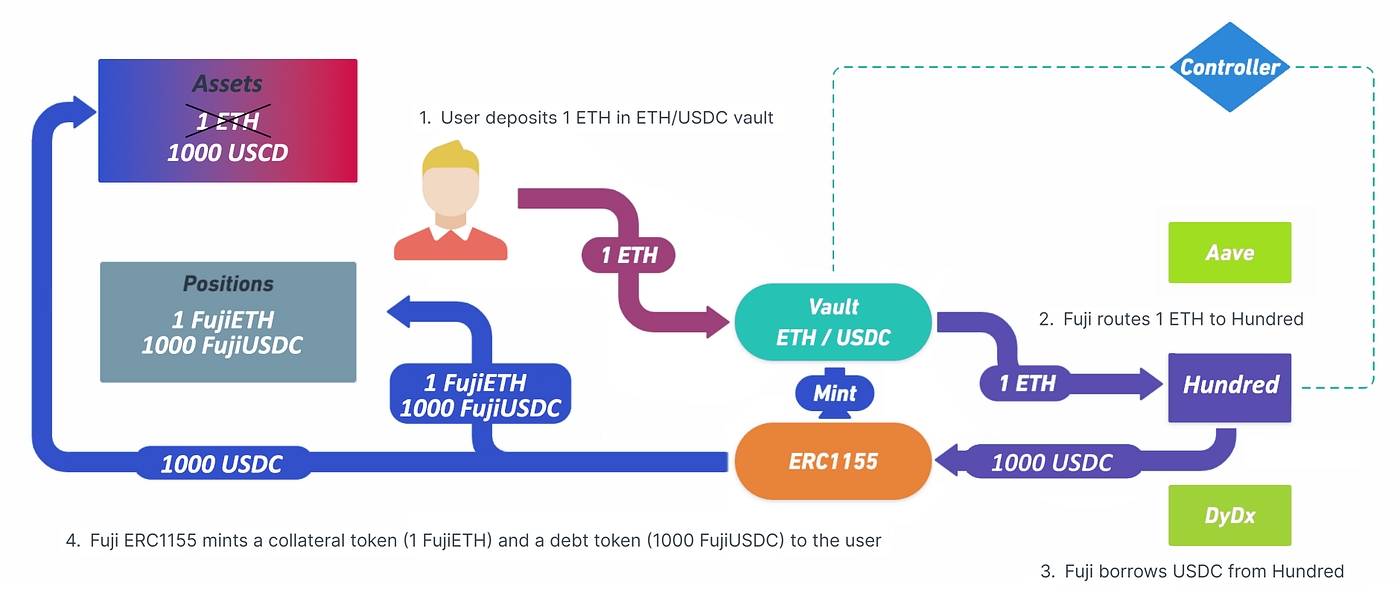

Fuji DAO is an aggregation protocol designed to obtain and maintain the best borrowing rates for its users. By creating vaults that pool and manage the distribution of funds across integrated protocols, it is able to minimize interest rates by granting greater economies of scale, reduce the time and energy required to manage a position and create a smooth and economically efficient user experience for those unable to follow the latest developments in decentralized finance.

Fuji DAO users are able to deposit a single asset as collateral and borrow another asset against it. When a user borrows from a Fuji vault, the needed liquidity is sourced directly from the base protocol providing the best rate. The protocol then tracks the user’s individual position and ensures the vault’s overall health through a classical liquidation mechanism. To avoid liquidation, a user needs to maintain the proportion of their debt to the amount of collateral they provided for that position above a certain threshold. The magic happens when, should market conditions change and a provider with a lower borrow rate for a certain asset emerge, the protocol triggers a rebalance operation and refinances the whole position of the vault. In this way, users instantaneously get a better rate on their loans without the need to take any action on their side.

Hundred Finance x FujiDAO Integration

Given Hundred Finance is especially devoted to providing stablecoin liquidity, having some of the best rates available for loans taken out in these assets, FujiDAO will benefit their users by automating access to our money markets. Users benefit pay less interest, while Hundred Finance platform is able to accrue greater fees from the increased volume of borrowing being conducted. What is more, aggregation of lending creates a net positive for the Fantom ecosystem as high gas fees are reduced as the necessity for many individuals to manage their positions is reduced and, as a result, so too is the number of potential transactions occurring on the chain.

Using FujiDAO

Using FujiDAO to lend and borrow assets is a simple process. To do so, first visit the dApp and connect your browser wallet.

You will then be presented with a full-feature dashboard that will allow you to select the asset to be borrowed using a qualifying collateral, in addition to the current APR you will pay on the loan (this APR includes a 0.2% addition to the underlying APY, paid to FujiDAO). Once your collateral has been deposited and your borrowed assets received, you will then be able to monitor the position according to its health factor. Be warned, should either the value of your collateral fall or the value of your borrowed assets increase to the point your health factor drops below 1, your account will become subject to liquidation. This will result in loss of a portion of your collateral, plus a liquidation penalty. For full details on the fees paid to FujiDAO, please be sure to carefully read their documents.

Last updated